Here’s an article designed to meet your requirements, focusing on readability, SEO, and user needs:

Inflation is a word that’s been on everyone’s lips lately. But beyond the headlines, what does it truly mean for you, your family, and your financial future? Inflation erodes the value of your money, making everything from groceries to gas more expensive. Understanding how it works and the extent of the inflation impact is crucial for making sound financial decisions.

Key Takeaways:

- Inflation reduces the purchasing power of your money, meaning you can buy less with the same amount.

- The inflation impact extends beyond everyday goods, affecting investments, savings, and long-term financial goals.

- Strategic financial planning is essential to mitigate the negative effects of inflation.

- Understanding different types of inflation helps in predicting future economic trends.

Understanding Inflation and Its True Consequences: The Basics

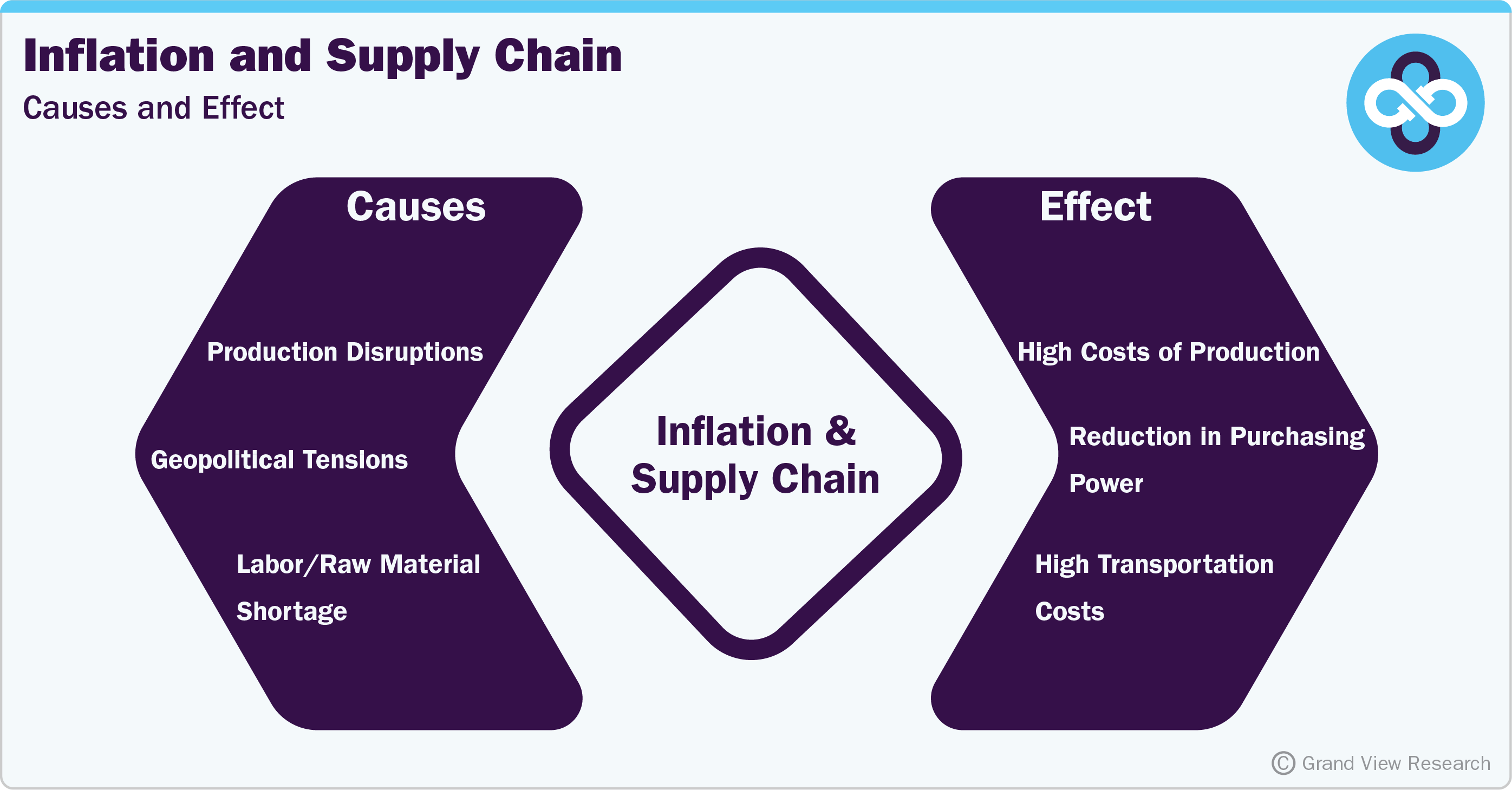

Inflation, at its core, is the rate at which the general level of prices for goods and services is rising, and subsequently, purchasing power is falling. Imagine a scenario where a basket of groceries cost $50 last year, and this year, the same basket costs $55. That’s a simple example of inflation. This increase can stem from various factors, including increased demand, supply chain disruptions, or government policies. It’s important to remember that not all price increases are due to inflation. Sometimes, a specific product might become more expensive due to scarcity or improved quality. However, sustained and widespread price increases across the economy are indicative of true inflation. Economists often use indices like the Consumer Price Index (CPI) to measure inflation, tracking the average change over time in the prices paid by urban consumers for a basket of consumer goods and services. Keep in mind, however, that these indices are averages, and your personal experience with inflation might differ based on your spending habits and location.

Examining the Inflation Impact on Your Wallet

The inflation impact is most directly felt in your wallet. When prices rise, your money simply doesn’t stretch as far. This means you need to earn more to maintain the same standard of living. For those on fixed incomes, such as retirees, inflation can be particularly challenging because their income may not keep pace with rising costs. Savers also feel the pinch. If the interest rate on your savings account is lower than the inflation rate, your money is effectively losing value over time. The real rate of return (interest rate minus inflation rate) becomes negative, meaning your purchasing power is decreasing even though your account balance is growing nominally. This is where strategic financial planning becomes crucial. Investing in assets that have the potential to outpace inflation, such as stocks, real estate, or commodities, can help protect your wealth. However, it’s important to carefully assess your risk tolerance and investment goals before making any decisions. Even seemingly small increases in inflation can have a significant cumulative effect over time, especially when compounded annually. Understanding the long-term inflation impact is essential for making informed financial decisions.

Analyzing the Inflation Impact on Investments and the Economy

The inflation impact isn’t limited to everyday expenses. It also affects investments and the overall economy. High inflation can lead to increased interest rates as central banks attempt to curb rising prices. Higher interest rates can make borrowing more expensive for businesses, potentially slowing down economic growth. This can also impact the stock market, as higher interest rates can make bonds more attractive relative to stocks. Real estate can act as a hedge against inflation, as property values and rental incomes tend to rise during inflationary periods. However, higher mortgage rates can make it more difficult for people to afford homes, potentially dampening demand. Certain commodities, such as gold and silver, are often seen as safe havens during inflationary times. Investors may flock to these assets as a way to preserve their wealth. Furthermore, businesses may face increased costs for raw materials, labor, and transportation due to inflation. This can lead to lower profit margins or higher prices for consumers, creating a ripple effect throughout the economy. Data centers, for example, may see increased costs for electricity and cooling, which could impact the prices they charge for gb of storage.

Strategies to Mitigate the Inflation Impact and Protect Your Finances

While you can’t control inflation, you can take steps to mitigate its inflation impact on your finances. First, create a budget and track your spending to identify areas where you can cut back. Negotiate better deals on your insurance, utilities, and other recurring expenses. Consider investing in assets that have the potential to outpace inflation, such as stocks, real estate, or commodities. However, diversify your portfolio to manage risk. Re-evaluate your savings strategy to ensure you’re earning the highest possible interest rate. Look for high-yield savings accounts, certificates of deposit (CDs), or money market accounts. Consider inflation-protected securities, such as Treasury Inflation-Protected Securities (TIPS), which are designed to protect your investment from inflation. Finally, stay informed about economic trends and consult with a financial advisor to develop a personalized plan that meets your needs and goals.